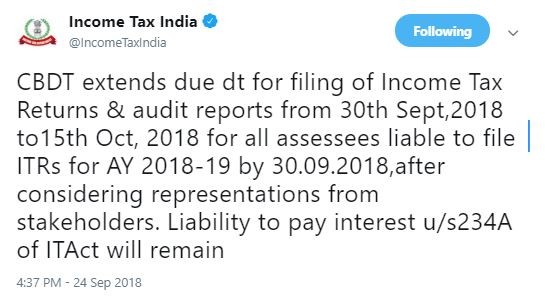

As usual CBDT has extended the due date for filing Income Tax Returns and audit reports from 30th September 2018 to 15th October 2018. However, there shall be no extension of the due date for purpose of Explanation 1 to section 234A (Interest for defaults in furnishing return) of the Act and the assessee shall remain liable for payment of interest as per provisions of section 234A of the Act.

Post Top Ad

Tuesday, 25 September 2018

CBDT has extended the Due Date for filing Income Tax Returns and Audit Reports

Tags

# IncomeTax

Share This

About CA Reddy

IncomeTax

Labels:

IncomeTax

Subscribe to:

Post Comments (Atom)

Post Bottom Ad

Author Details

"Great minds discuss ideas; average minds discuss events; small minds discuss people"S Praveen Kumar Reddy, qualified as Chartered Accountant in 2018. Experienced Person with a demonstrated history of working in the Taxation and Accounting industry. Skilled in GST returns Filing, Accounting, Personal Income Tax Returns, Corporate Law, Microsoft Excel and Tally ERP...

This short article posted only at the web site is truly good.

ReplyDeleteIn simple words income tax is a tax paid on any kind of income. The law mandates all individuals who have income over a certain amount must pay income taxes. Taxable income can include wages, interest on investments, capital gains, prizes, and pensions. Income tax help refers to the tax help offered to individuals who do not know how to figure out complicated tax returns. The main reason why people are seeking income tax help is that they are afraid of doing something wrong on their taxes, which can lead to troubles with the IRS for years to come. life insurance

ReplyDeleteIt is very simple to complete the process of e-filing. Most online tax preparation services which use e-filing will automatically figure out the amount of tax owed. check this link

ReplyDelete